Carlos and Juany Chico went to several national banks for a loan to expand their lakeside food stand to a brick-and-mortar restaurant location. Like most small and startup entrepreneurs, they were turned down because they didn’t fit the lending requirements of traditional banks. That’s when they turned to the nonprofit lender DreamSpring for a small loan to fund operating and inventory expenses at the new location.

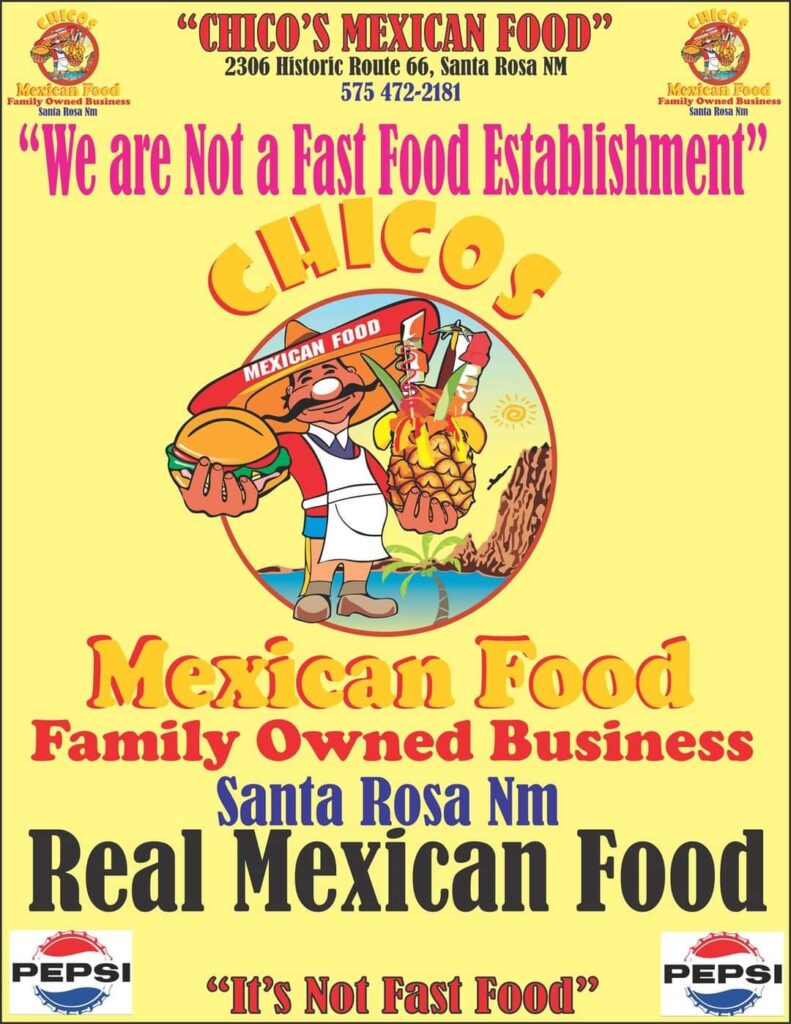

Chico’s Tortas y Pinas Lokas, now known simply as Chico’s Mexican Food, now operates out of a former KFC Restaurant building on Historic Route 66 in Santa Rosa and serves patrons in nearby Tucumcari from a food truck. The business is thriving, thanks to the tight-knit family of 12 and other staff, along with several DreamSpring loans that have enabled the company’s growth.

“DreamSpring is a good option,” Carlos said for people who don’t meet the lending requirements of traditional banks.

Continue reading