Do you make beef jerky at home? Or maybe homemade sausage in your garage? Aspiring meat processing entrepreneurs can get business assistance and loan advice from the Biz Sprint program Arrowhead Center.

Continue readingTag Archives: small business loans

Loan Request Mistakes to Avoid

The nonprofit small business lender LiftFund has helped thousands of small business owners navigate the funding landscape, and they’ve noticed some common pitfalls along the way. These are the three biggest mistakes LiftFund lenders have seen new business owners make – and how you can avoid them.

Continue readingConferences Offer Business Resources, Loans, and Networking

Several June and July conferences aim to offer networking opportunities and equip participants with knowledge about business resources and available capital, including loans and grants. The nonprofit lender and business development organization WESST is offering a half-day Women’s Entrepreneurship Conference in collaboration with Arrowhead Center at NMSU on July 18. The Atomic 66 Convergence of Space, Art, Tech, and Culture takes place June 10 to 13, and the Women Veterans Conference is June 14, 2025.

Continue readingSBA Loans Offer Low Interest Rates

Kelley and Steve Cherry were so pleased with the experience of securing a loan to buy one commercial building in Red River that they want to buy another building the same way.

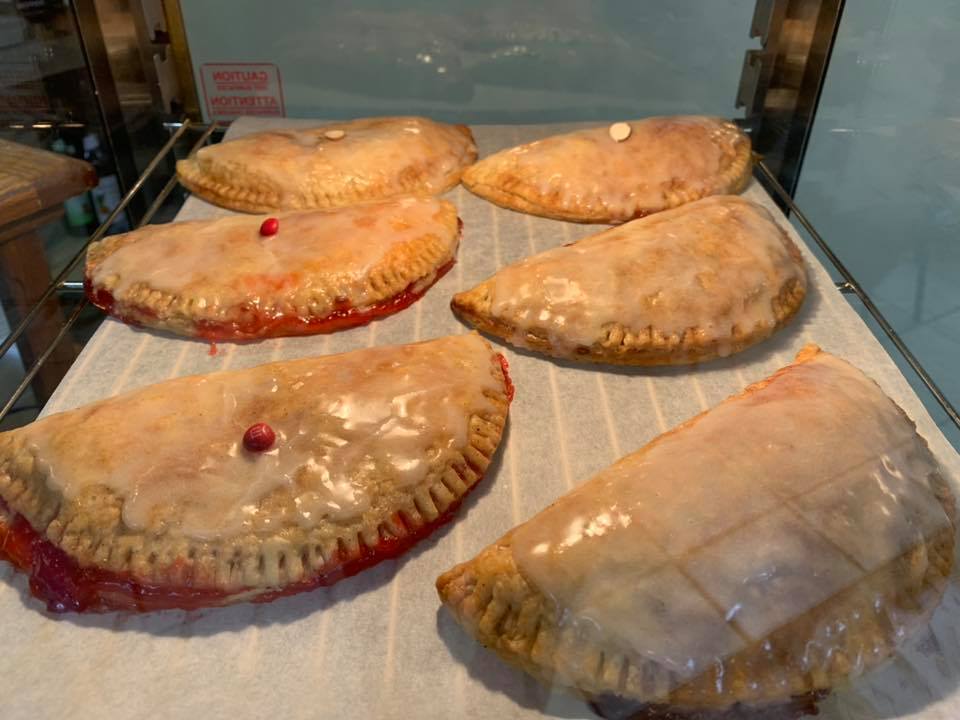

The couple worked with Century Bank to obtain a U.S. Small Business Administration 504 loan to purchase the building they previously leased for their 3-year-old ice cream and sweets shop, L’il Willie’s Shenanigans. They hope to use the same strategy to buy the building from which they’ve operated Shotgun Willie’s Café for the past decade.

The appeal of 504 loans is that interest rates are fixed at a significantly lower rate than traditional banks offer for commercial real estate loans, and borrowers get lots of help from lenders and the certified development companies that evaluate 504 loan packages for the SBA. The nonprofit Enchantment Land Certified Development Company played that role for the Cherrys.

Continue readingPrepare for a Small Business Loan

Clearinghouse CDFI is hosting a webinar at 12:00 pm on Wednesday, May 28, 2025, to help businesses, developers, and nonprofit organizations prepare to apply for a small-business loan.

Continue readingWESST Named NM Microlender of 2025

The nonprofit business development organization WESST has been named the New Mexico Microlender of the Year 2025 by the U.S. Small Business Administration. Known best for its workshops and business consulting, WESST has a loan fund that offers microloans to qualifying businesses that work with its consultants.

Continue readingHistoric Childcare Center to Double Capacity

Christina Kent Early Childhood Center (CKECC), Albuquerque’s oldest continuously operating childcare center, is set to significantly expand its services through the purchase and renovation of a new building, thanks to a community-centered partnership with Homewise. The expansion will allow CKECC to double its capacity, offering critical early education to even more families in the Barelas neighborhood and across Albuquerque.

Established in 1919, CKECC has served the Albuquerque community for over a century, providing high-quality childcare and early childhood education to low-income families. The center, accredited by the National Association for the Education of Young Children (NAEYC), currently serves 62 children in three classrooms and is committed to ensuring accessible education through a sliding scale tuition model that considers both income and family size. Through its participation in the NM PreK program, CKECC also offers free tuition for 3- to 5-year-olds.

Learn to Use QuickBooks to Manage Business Finances

April is Financial Literacy Month, and for business owners, that means getting business finances in order. The business development organization WESST is offering a workshop in Santa Fe from 10:00 am to 12:00 pm on April 22, 2025, to teach business owners how to use the QuickBooks financial and accounting software.

Continue readingBusiness Resource Information from the Pros

The New Mexico Small Business Development Center in Farmington is teaming with at least twelve other business resource organizations at an in-person event at the San Juan College Quality Center for Business on March 20, 2025. The event aims to connect small businesses with resources that can help them grow.

Continue readingLine of Credit Boosts Security Entrepreneur

Like many entrepreneurs, Adrian Chavez, Sr. did not intend to start a security business.

Chavez created Lobo Protective Services in 2017 after working as a security guard to earn income while studying political science at university and paying for his wedding. It was working that job that he was approached by someone who noticed his work ethic and integrity.

“This woman said, ‘I never met someone like you in the industry. If you open your own company, I will hire you for my next project,’” Chavez recounted.

Chavez wasn’t well versed in the security field at the time, but he would hear that there weren’t many reputable or state-licensed security companies.

After that conversation and a discussion with his wife, Chavez decided to take the entrepreneurial leap. “It’s not rocket science. It’s doing good, doing what you say, and saying what you mean,” Chavez said.

Continue reading