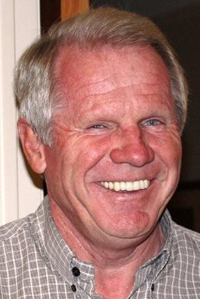

Paul F. Goblet, Financial Advisor, NM SBIC

Tight credit markets of the past few years have made it difficult for business owners to obtain loans to expand their business. Getting a loan is still as hard as ever, even though most financial institutions have plenty of capital to lend. With the interest rate charged banks by the Federal Reserve Bank at almost zero, it’s surprising so little capital is moving around. Loans, as a percentage of deposits, are very low.

Credit will loosen eventually because banks can’t survive long-term without making loans. Stung by losses when loans defaulted, banks are understandably more conservative; but they need interest revenue from loans to grow.

Recent financial activity suggests money might be starting to flow again. Continue reading