Entrepreneurs and investors come together on February 5 and 6 in Taos during the Ski Lift Pitch, a pitchfest event designed to introduce New Mexico high-growth startups to equity investors. Pitch companies were selected in early January from submitted applications, but startup founders are encouraged to attend as observers to learn what goes into a successful pitch.

Continue readingTag Archives: entrepreneur

Black Business Summit Kicks Off Black History Month

The City of Albuquerque, in collaboration with a multitude of partners, is kicking off Black History Month with a summit that aims to equip Black entrepreneurs and business owners with the resources to help their businesses grow. February is Black History Month, and the summit will take place February 7 and 8 at the Albuquerque Convention Center.

Continue readingWhat is an Entrepreneur?

According to Lorena Schott, entrepreneurs pop up in all types of industries and can have widely different backgrounds. “Really anyone can be an entrepreneur, given the idea and the right tools to develop it into a functional business,” she said.

Schott should know. The director of marketing communications at WESST has met thousands of entrepreneurs since joining the business development organization in 2009. WESST is a nonprofit organization that offers business consulting, workshops, financial resources, business incubation, and support to help entrepreneurs start and grow a business.

“An entrepreneur is someone who sees a need and takes on the financial risk to start a business to fill that need,” she said in a WESST blog post. “It may sound vague, but that’s the point; there is no cookie-cutter entrepreneur…”

Schott contrasts the ‘classic’ entrepreneur — someone who creates a business like a new restaurant or a tech start-up — with today’s entrepreneurs. “There has been a shift in the global job market that has opened the door for entrepreneurship to become more mainstream,” she said.

Continue readingProgram Embeds Tech Entrepreneurs at NM Labs

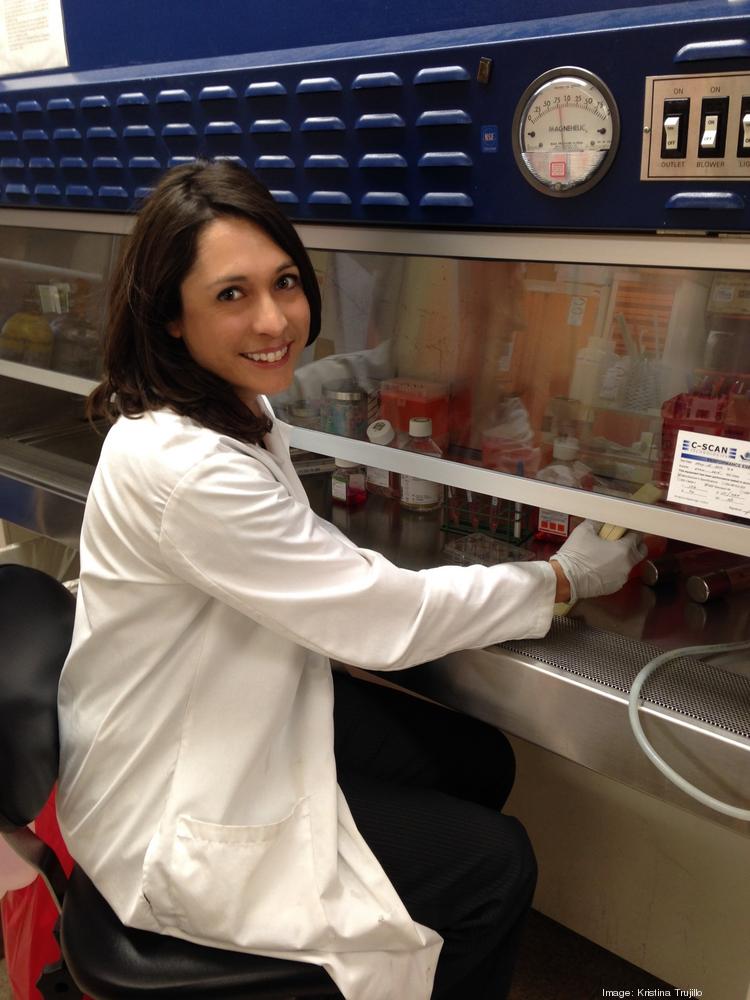

Molecular biologist Kristina Trujillo is determined to help physicians identify and treat Alzheimer’s disease before the onset of debilitating cognitive decline.

Trujillo, who holds a doctorate in molecular biology from New Mexico State University, is CEO of Albuquerque-based T-Neuro Pharma. With help from the New Mexico Lab-Embedded Entrepreneur Program (LEEP), her company is developing a simple blood test to determine the presence of Alzheimer’s disease and a treatment to prevent its development and stop its progress.

She is one of three technology entrepreneurs in New Mexico LEEP’s first two-year fellowship cohort, which started early this year. The program embeds “deep tech” entrepreneurs—people developing solutions to existential problems like climate change and disease—at Los Alamos National Laboratory, where they work alongside scientists and mentors to advance, test and validate their innovations on a path to making them marketable products.

Continue readingCoworking Space Helps Vet Build Gourmet Popcorn Business

A decade ago, Roberto Mendez was broke, his real estate business wiped out by a devastating recession and his wife sidelined by a debilitating stroke. Today he runs a thriving family business built on his favorite snack food: popcorn.

A decade ago, Roberto Mendez was broke, his real estate business wiped out by a devastating recession and his wife sidelined by a debilitating stroke. Today he runs a thriving family business built on his favorite snack food: popcorn.

“Ten years ago, life was hell,” said the owner of Albuquerque-based Cornivore. “We were trying to survive, so we would make a couple of hundred bucks here and there” selling homemade gourmet concoctions created in a kettle corn popper to friends and acquaintances.

Cornivore was a bootstrapped business, started with Mendez’s limited resources, as no one would lend to him at the time. First, he found a niche market—people willing to pay several dollars for a bag of fresh popcorn coated with natural flavors. Then he expanded his clientele beyond friends and family, experimenting with wholesaling and concession sales before landing a ready-made sales force in the fundraising market. Continue reading

Startup Weekends Turbo-Charge Business Ideas

Startup Weekend Albuquerque is Feb. 22 – 24, 2019 at WESST Enterprise Center.

Launching a business can take years — or it can take 54 hours of intense teamwork with experts and entrepreneurs who share a hunger to develop ideas into profitable enterprises.

Startup Weekends are just the place for such collaboration, and the next one planned for New Mexico happens Feb. 22-24 in Albuquerque.

Organized by small business development organization WESST, CNM Ingenuity, ABQid and with support from New Mexico Mutual Insurance, this Startup Weekend is a global project of Google for Entrepreneurs and Techstars. The goal is to create a supportive environment where budding entrepreneurs can pitch and fast-track a business idea through realistic feedback from peers and experts. Continue reading

Predictive Analytics Isn’t Just for the Big Guys

Image courtesy of Carlos Muza. Article by Sandy Nelson.

Predicting consumer behavior can be an obsession for businesses, no matter what their size. Big corporations dedicate entire departments to divining what people will want next so they can be first to offer it, and they invest massive amounts of money into predictive analytics—the mining of massive sets of data for patterns and trends in hopes of giving businesses a competitive edge by helping them predict the future.

Smaller businesses typically don’t have the means or need to invest in the sophisticated types of data crunching that their larger cousins do, but smaller-scale data analysis tools can help them track past and real-time trends and behaviors so they can make fact-based decisions about how to allocate resources. Continue reading

Funds aim to spur growth of six Native American ventures

Bison Star Naturals owners Jacquelene and Angelo McHorse with daughter Judy. Article by Damon Scott.

(note from editor: The RDC now manages the Tribal Economic Diversity Fund, more information here )

Bison Star Naturals is one of six enterprises that shared $60,000 of investment in 2018 as part of the Native American Venture Acceleration Fund program administered by the Regional Development Corporation. NA VAF aims to create jobs by boosting revenue and advancing the business goals of Native American-owned Northern New Mexico companies.

Jacquelene and Angelo McHorse, owners of Bison Star Naturals, sought the funds to launch a line of liquid jojoba and yucca root soap to augment the bar soaps and lotions the business is known for.

“We also are expanding our line to include our unscented lotion,” Jacquelene said. “The funding allows us to release a new product line and expand our current offerings — which are great leaps for our small business.” Continue reading

NMSBA Program Brings Small Businesses, National Laboratories Together

Honeymoon Brewery hosted its grand opening in Santa Fe in 2018. Article by Jason Gibbs.

The crew from Santa Fe’s Honeymoon Brewery is raising a glass to the New Mexico Small Business Assistance Program and offering a hearty “salud” to David Fox of Los Alamos National Laboratories.

The cause for celebration? The successful pairing of a small-scale kombucha brewing business and a scientist at one of the nation’s premier research laboratories that was made possible through the NMSBA, a free program that gives small business owners in New Mexico access to the resources available at both LANL and Sandia National Laboratory.

For Honeymoon founders Ayla Bystrom-Williams and James Hill, working with LANL’s Fox allowed them to refine their brewing process and scientifically cut through a trial-and-error development process to better understand how to achieve the particular flavors they sought. Continue reading

Startup Resources Intrinsic to Business Success

With help from Accion, ‘magic,’ passion, comfort with risk are other key ingredients.

Daven Lee, Owner of Love+Leche; Article by Sandy Nelson

Borrowing money to start or build a business entails taking risk — not just for the lender but also the borrower. But unless the entrepreneur has rich relatives or massive savings to draw on, securing capital usually requires multiple loans over many years to start and expand a business.

Daven Lee has tapped into New Mexico’s many small-business resources over nearly two decades to turn Love + Leche from a home-based maker of handmade soaps and lotion bars — made with milk from her own goat herd and other natural products — for retail sale into a viable year-round business that gets about half its revenue from wholesale markets throughout the U.S. and in Mexico, England and Australia. Continue reading