The Internet has linked New Mexico businesses with a worldwide web of customers, and it’s also provided a universe of cost-cutting and time-saving tools that are simplifying many aspects of running a business. Better yet, many of these tools are free or affordable.

The Internet has linked New Mexico businesses with a worldwide web of customers, and it’s also provided a universe of cost-cutting and time-saving tools that are simplifying many aspects of running a business. Better yet, many of these tools are free or affordable.

Many businesses already use social media sites like Facebook and Twitter to advertise products, offer discounts and interact with customers. Even critical comments from customers help businesses by pointing out correctable problems with service or products; they’re a cheap form of damage control and quality control. Continue reading

In 2011, New Mexico was authorized to receive $13.1 million from the U.S. Treasury Department as part of the State Small Business Credit Initiative — a product of the Small Business Jobs Act of 2010.

In 2011, New Mexico was authorized to receive $13.1 million from the U.S. Treasury Department as part of the State Small Business Credit Initiative — a product of the Small Business Jobs Act of 2010.

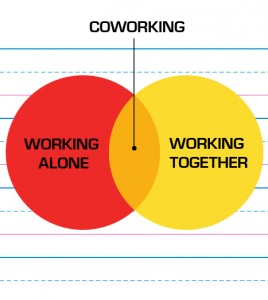

The dramatic increase in freelancers, especially technology industry soloists, is driving a new trend called “coworking” — the sharing of workspace on the basis of a desire for community that its proponents see as a basic human need.

The dramatic increase in freelancers, especially technology industry soloists, is driving a new trend called “coworking” — the sharing of workspace on the basis of a desire for community that its proponents see as a basic human need.