Municipalities, businesses, tribes and economic development and other community organizations eager to attract capital investment to economically distressed areas of New Mexico have another avenue to do so.

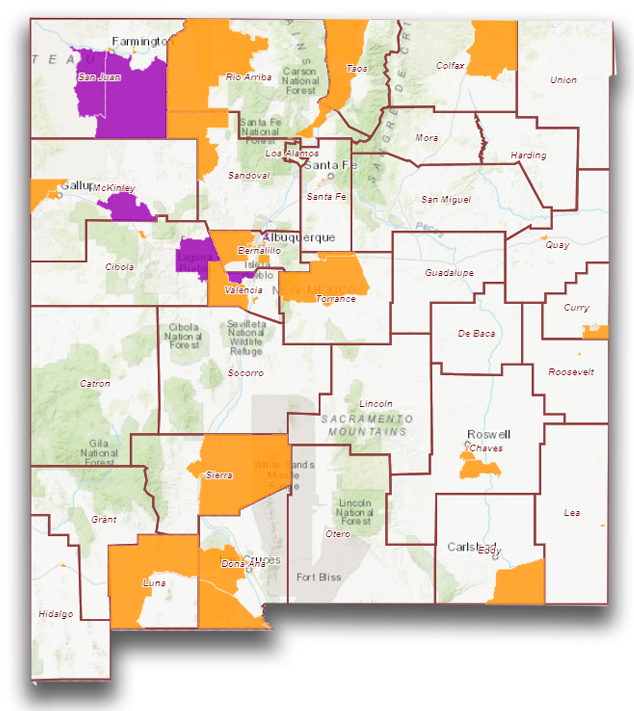

One provision of the Tax Cuts and Jobs Act of 2017 law allowed governors to nominate qualified census tracts in their states as Opportunity Zones (OZs). That designation offers tax incentives for individual entrepreneurs, partnerships and corporations to invest in communities where unemployment and poverty are high. New Mexico has 63 such zones scattered among 22 of the state’s diverse counties and tribal lands.

To sweeten the offer, the state is providing $1 million OZ Jobs Bonus to investments that meet certain OZ project benchmarks and help the state’s economy diversify.

The federal tax initiative is tantalizing in New Mexico, where outside financing can be hard to attract. Investors can defer, reduce or even remove certain capital gains taxes from OZ real estate and business investments made through a qualified Opportunity Fund that benefits affected communities.

Continue reading