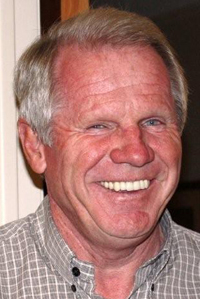

F. Leroy Pacheco, CEO, The Loan Fund

The credit crunch is a new nightmare for some borrowers, but entrepreneurs and start-ups of modest means were only too familiar with being turned down for traditional financing even before the economy went sour.

Private alternative lenders such as The Loan Fund have helped such borrowers build self-sufficient businesses for years. Since the Wall Street meltdown, we’ve been getting more referrals from loan officers at local banks who know we have more flexibility than they do and can make a loan or authorize a line of credit of up to $1 million.

Bankers aren’t bad people; our board of directors includes several of them. They want to help business owners, but their hands are often tied by federal regulations and mandates from above — and those restrictions have only increased recently. One banker told me applicants must now have a minimum credit score of 650 and three years of profitable financial reports before the bank even considers making a loan.

Because we’re a private group that balances social benefits and fiscal responsibility, The Loan Fund has more flexibility when it comes to helping our clients get (and keep) going. One such client, Carley Preusch of Silver City, was turned down by four banks that considered her profit margin “too low.” We loaned her $125,000 in July to expand her assisted-living center.

Continue reading →