ActivateNM powered by CNM Ingenuity offers “office hours” for New Mexico startups and small businesses. Office Hours are a facilitated regular gathering of the growing ActivateNM community of entrepreneurs and mentors who get together to talk about pressing business questions their ventures are facing. The next monthly meeting will take place online on August 20.

Continue readingTag Archives: business assistance

Second Round of LEDA Grants Opens

The New Mexico Finance Authority, which manages the state’s LEDA pandemic grant program, is accepting applications under a second round of funding. The first-round application period was widely publicized to end on June 15, 2021. A second-round application period opened as soon as the first round closed. The deadline for application acceptance in the second round is slated for June 30 at 12:00 noon, and additional rounds may be added if funding is available.

Continue readingWESST a ‘Touchstone’ for Therapy Clinic Partners

Two months after COVID-related emergency orders shuttered the clinic that employed them, Melissa Esquibel and three colleagues launched Sandia Sunrise Therapy LLC to provide vital physical and occupational therapy services.

“Starting the business in the middle of a pandemic was definitely challenging,” clinic administrator Melissa Esquibel said. “We all worked very closely together (at the clinic that closed in March 2020). Keeping that connection was very important to us as we started the new business.”

Esquibel’s co-founders Teresa Ziomek and Oksana Tretiak practice occupational therapy, and Dr. Heather Armijo provides physical therapy. While all four women contributed to the business’s formation, Esquibel credits Ziomek with organizing the team and Tretiak with contacting business-development nonprofit WESST to help with the team’s strategic plan and other critical startup groundwork.

Before meeting with WESST, the four had written a business plan. “We drafted our goals, did our analysis on the market and the services we were going to provide,” Esquibel said. This laid the groundwork for their work with WESST, which has been offering its services at no cost during the pandemic.

Continue readingBusiness Support for Veterans

New Mexico is home to more than 124,000 veterans, a population tied for the sixth-highest concentration in the nation. Almost half of them are under the age of 65. For those former service members interested in operating businesses, nonprofit organizations and state and federal agencies can help with business formation, certification, and contract acquisition that levels the playing field for vets who have spent their careers out of the private sector.

Veterans come to the private-sector workforce with a lot to offer, including advanced training in specialized fields such as logistics, security, information technology, personnel management and administration. They understand the complexities of doing business with the U.S. government and the importance of following instructions and protocol. They appreciate the need for teamwork and leadership, and they work well under pressure. In other words, veterans have the skills needed to start and manage a business.

Continue readingLibraries Poised to Become Post-Pandemic Entrepreneurial Hubs

When New Mexico libraries finally return to pre-pandemic hours and services, many will offer even more resources than they did in the past, especially to entrepreneurs.

Public libraries are ideal places to nurture people who want to start their own businesses: They are community hubs with deep roots, and local librarians are portals to knowledge, tools, and ideas that can create jobs, build the local work force, and drive development. Libraries are trusted, safe and welcoming spaces that offer culturally and economically diverse patrons free access to computers with internet access, meeting rooms, and other spaces where entrepreneurs can meet and brainstorm.

Libraries can be entrepreneurial centers in some of the same ways business incubators are, because they provide networking opportunities, vast resources and a platform for information sharing. And they can support the next generation of entrepreneurs without the expense of building, maintaining and managing a separate, limited-use facility.

Continue readingWESST: Trailblazers in the WBC Movement

There are currently over 100 Women’s Business Centers across the United States, but in the late 1980s, there was a scarcity of female entrepreneurs and role models. Spurred by the growing interest among women to chart their own business and financial path and seeking to provide appropriate the resources, WESST was established in 1989 and became a leading pioneer in the movement across the country.

WESST is currently among a handful of economic development organizations across the country that hosts a network of Women’s Business Centers. Each of the six regional Enterprise Centers located throughout New Mexico offers special training and consulting programs geared to aspiring or established women business owners. Continue reading

Build a Business with Relationships

No one likes to feel hustled while shopping, whether it’s in a retail store or trade show booth.

No one likes to feel hustled while shopping, whether it’s in a retail store or trade show booth.

To attract customers without brazen hawking or downright pushiness, businesses need to refine the art of the soft sell. That begins by making the store or trade show booth an intentional destination for people who are truly interested in what the business sells.

Create relationships

While any business would like to sell at least one product to every person who walks in the door, that’s the type of unrealistic goal that can turn sales reps into apex predators.

A long-term perspective toward potential customers focuses on developing a relationship that lasts longer than one transaction. It lays a foundation through attraction rather than persuasion. Continue reading

Manufacturing Make-Over Reaps Rewards for Albuquerque Business

C. Aaron Velasquez knew it was time to modernize the equipment and processes his family’s metal-plating business had used for four decades, but he wasn’t sure where to start.

C. Aaron Velasquez knew it was time to modernize the equipment and processes his family’s metal-plating business had used for four decades, but he wasn’t sure where to start.

An industry contact introduced him to New Mexico Manufacturing Extension Partnership (NM MEP), a nonprofit that trains manufacturers in lean principles, value-stream mapping and other methodologies that help businesses increase profitability and competitiveness.

Theta Plate, a second-generation, family-owned Albuquerque-based business, specializes in electroplating of precious metals for industrial and commercial uses, such as friction reduction and conductivity enhancement in electrical and computer components and applications that improve the radiance of costume jewelry. Continue reading

NM FAST Program Propels Anti-Counterfeit Entrepreneur

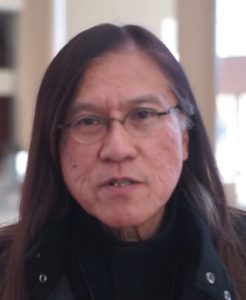

Roy Montibon worked with the New Mexico FAST program. Article by Jason Gibbs.

Heritage. Honesty. Respect for tradition.

These are keys to Roy Montibon’s work as CEO of Montibon Provenance International Inc. His mission to ensure the authenticity of Native American art has drawn support from New Mexico State University’s Arrowhead Center, the Small Business Administration, and the respect of collectors and artists alike.

In 2017, Montibon tapped into resources offered by the New Mexico Federal and State Technology Partnership (NM FAST) program to develop a system to prevent counterfeit merchandise from polluting the Native American art market. Shoddy knock-off merchandise not only devalues the market, but it devalues the work that honest artists produce and harms the overall market, he said.

“The financial impact is three-fold,” said Montibon. “Collectors are ripped off. Native artists are deprived of revenue from sales of work that is falsely attributed to them. And, because the fake work is of poor quality compared to authentic work, the perceived value of the artist’s work is diminished in the marketplace, which also has a detrimental effect on future generations who may be considering a career in the arts.” Continue reading

State Offers Grants to Promote Tourism

New Mexico attracts more visitors every year, but the state wants to further boost tourism and related revenue by expanding on successful programs like New Mexico True and the Cooperative Marketing Program (CoOp).

New Mexico attracts more visitors every year, but the state wants to further boost tourism and related revenue by expanding on successful programs like New Mexico True and the Cooperative Marketing Program (CoOp).

New Mexico True is a brand that businesses, governments and nonprofit organizations can use by partnering with the New Mexico Tourism Department. That involves demonstrating how the organization expresses or evokes the state’s distinctive landscapes, cultures, food, art or history.

The CoOp program gives local nonprofits, municipalities and tribal governments a financial incentive to market what’s uniquely New Mexican about their event or location and even participate in existing advertising campaigns. Through the CoOp program, state money is leveraged with money from other public entities to amplify media buying power for all involved parties. (Private businesses can contribute up to 50 percent of a public entity’s total CoOp investment.) Continue reading