Technology Ventures Corporation and New Mexico WIRED (Workforce Innovation in Regional Economic Development) host their third virtual high tech job fair September 20-24. Because the setting is cyberspace, applicants can participate from anywhere in the world without standing in long lines.

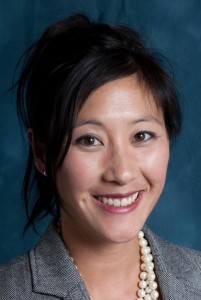

New Mexico-based high tech and green tech companies that want to participate can register for their virtual booth by contacting Metta-Marie Stahl at 505-843-4143. The fair is limited to these industries because job-fair organizers say they offer opportunities for professional growth and better-than-average pay. (And they’re not all technical jobs, either: Many companies seek sales and marketing personnel and administrative staff.)