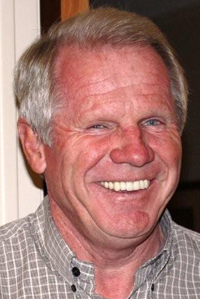

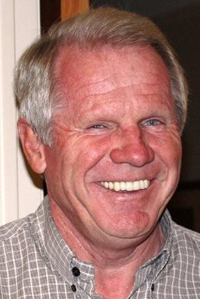

Scott Caruso, Partner, Flywheel Ventures

In the wake of a financial crisis that spread quickly from Wall Street to the rest of the world, many small businesses are finding traditional funding sources, including debt financing, harder to secure. Many entrepreneurs are consequently turning to venture capitalists to finance the growth of their businesses.

The decision to seek venture capital is a strategic one that requires thought and planning. Venture capitalists generally invest in high-growth companies that have potential to create a sizable return. Venture capital isn’t for everyone, but it’s ideal for companies aiming to acquire a large market share in their industries until they can be acquired by a bigger player or go public.

When looking for venture capital, it’s critical to target a firm whose mission and goals align with your own and to understand the firm’s economics and investment patterns. Doing this important legwork before seeking venture-capital funding will allow you to be more efficient and successful in achieving your funding goals.

Sizing up the venture-capital alternatives: The first step is to qualify the firms you plan to approach, beginning with fund size, the clearest indicator of a firm’s investment strategy. A firm that operates a $50 million fund might make investments between $2 million and $5 million, while a $500 million fund might make investments in the range of $15 million to $20 million. Understanding the amount of capital a firm is willing to invest helps you determine if it can meet your funding needs.

Continue reading →