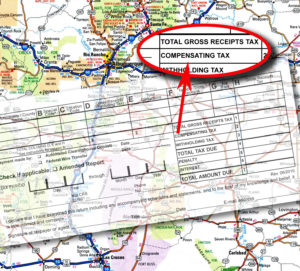

Lots of New Mexico business owners don’t realize they’re required to pay a “compensating tax” for business-related purchases they make on the internet or in a state that doesn’t charge sales tax.

Some know they’re supposed to but they ignore it, assuming the state will never discover the nonpayment.

Most of the time, that’s a safe assumption because the state can’t monitor everything a business does. But it’s risky, nevertheless, because an audit could uncover the nonpayment and this discovery could result in a hefty fine — especially if the business acquires much of its raw materials from out of state, depriving New Mexico of significant tax revenue. Continue reading