By Sandy Nelson, Finance New Mexico

By Sandy Nelson, Finance New Mexico

Editor’s Note: This program is now known as the Collateral Assistance Program.

Joshua Grassham recognized a novel approach to supporting small business financing when he saw one. The vice president of commercial lending at Lea County State Bank in Hobbs was the first New Mexico banker to secure a client’s loan through a new state program to help collateral-poor businesses.

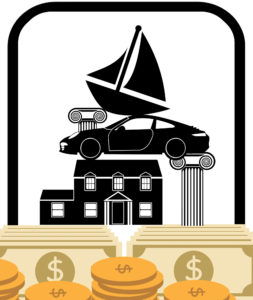

The New Mexico Economic Development Department (EDD) introduced the Credit Enhancement Program (CEP) earlier this year as a way to help businesses, especially startups, by purchasing short-term certificates of deposit that businesses can use as collateral for larger loans.

Grassham closed his first loan in February on behalf of a longtime customer who wanted to start his own business serving the oil and gas industry. The customer had good credit and a sound business plan, but he lacked sufficient collateral to support his startup loan. The CEP loan bridged that gap.

Grassham has two more CEP loans in the pipeline — one for a new restaurant and the other for a senior care facility.

Temporary Support

CEP falls under the State Small Business Credit Initiative, which Congress financed in 2010 to stimulate bank lending after the financial meltdown and recession of 2007-2008.

In 2011, New Mexico received $13.1 million and disbursed most of it to the New Mexico Finance Authority to lower loan interest rates for qualified businesses. When that program ended, the state created CEP as a gap assistance program “for businesses that are struggling to find 100 percent of the collateral needed,” according to EDD finance development specialist Johanna Nelson.

CEP funds are used to buy a two- to three-year-term CD in the amount of the collateral deficit — up to 50 percent of the loan principal. The minimum CD value is $25,000; the maximum is $250,000.

The customer makes payments toward principal and interest, and once the CD term ends, the funds return to the program to help another business. By the time the CD expires, the business typically has enough collateral to independently support the bank loan.

Targeting the Underserved

EDD especially wants to serve underserved markets, including rural areas with fewer than 50,000 people and communities with people earning low to moderate incomes. Manufacturers, green businesses and businesses that receive at least half of their revenue from outside the state are targeted, as are businesses run by minorities, women and veterans.

Once enrolled in the program (a process that can take 30 days), bank and Community Development Financial Institution lenders apply for a client’s project by submitting a two-page description of the business plan and financial projections. EDD qualifies the application and sends it to the CEP Review Group, which approves or denies it within five days.

The lender then underwrites the loan, and the EDD funds the bank CD. The lender provides the EDD regular updates on the status and economic impact of the loan.

Borrowers can contact EDD for information, but they are urged to first find a participating lender on the EDD website at gonm.biz. Please see the EDD’s newest website here.

Download 558_State Program Helps Businesses Clear Loan Collateral Gap PDF