Lots of New Mexico business owners don’t realize they’re required to pay a “compensating tax” for business-related purchases they make on the internet or in a state that doesn’t charge sales tax.

Some know they’re supposed to but they ignore it, assuming the state will never discover the nonpayment.

Most of the time, that’s a safe assumption because the state can’t monitor everything a business does. But it’s risky, nevertheless, because an audit could uncover the nonpayment and this discovery could result in a hefty fine — especially if the business acquires much of its raw materials from out of state, depriving New Mexico of significant tax revenue.

Evening the Playing Field

The compensating tax is a “use” tax that’s imposed on the value of property that a company acquires from an out-of-state business — typically through an internet-based vendor — that would have been subject to the gross receipts tax (GRT) if it have been purchased in New Mexico. It doesn’t apply to purchases made by individuals for personal use.

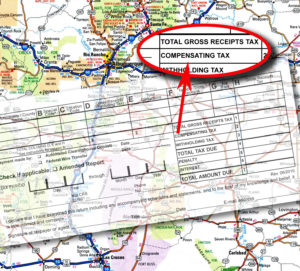

Businesses are required to report such purchases on the New Mexico Tax & Revenue Department’s combined reporting system — the same place they report and pay GRT — and they’re supposed to pay 5.125 percent for goods and 5 percent for services. If the business paid sales taxes to the vendor’s state, that amount can be deducted from what the business would owe New Mexico, and if the business paid more than New Mexico’s top GRT rate of 5.125 percent, the compensating tax would be waived.

From the state’s perspective, when a business evades this tax, it’s giving a competitive advantage to companies from states that don’t assess gross receipts or sales taxes and thus undermining economic development at home. It also deprives the state’s general fund of vital revenue and shrinks the funds the state uses to help small cities and counties.

Businesses that follow the law contribute $47 million to the state’s annual revenues. While that’s a fraction of New Mexico’s total tax revenue, it might be more significant if all businesses — especially those that source much of their raw materials out of state — declared and paid taxes on eligible purchases.

It’s hard for the state to know what it might be missing out on, according to Richard Anklam, president and executive director at the New Mexico Tax Research Institute, because compliance is “voluntary,” just as it is for reporting GRT. Businesses are required to pay the tax, but it’s up to them to initiate that process.

Cost of Getting Caught

Getting the best deal on the purchase of office equipment, furnishings and supplies makes business sense, and it’s understandably tempting to buy from a seller that doesn’t add sales taxes or GRT to the final bill.

While tax officials don’t have the resources to track such purchases by businesses or to enforce the law before the fact, when they audit a business they suspect of GRT tax evasion, they also check for compliance with the compensating-tax law.

“The biggest offenders are small businesses,” Anklam said, either because they don’t understand the compensating tax or don’t believe it applies to them.

For more information about this tax and the products and services it applies to, visit http://www.tax.newmexico.gov/Businesses/compensating-tax.aspx.

Download 481_tax-on-out-of-state-business-purchases-aims-to-keep-new-mexico-competitive PDF