Businesses invest lots of human and capital resources into marketing, asset purchases and outreach. Their goal is to generate the best return on every dollar spent, every hour worked and every keystroke made.

Return on investment, or ROI, measures how much money or other tangible benefits the business makes on every investment.

For example, if a business invests in a modern computer system to expand its reach and improve its service to Internet shoppers, the return on investment would measure how many new customers it gained and how much these newcomers spent. These gains would be analyzed in relation to the amount of the investment.

ROI should be considered for every business investment, and various formulas can be used.

Classic Formulas and Variations

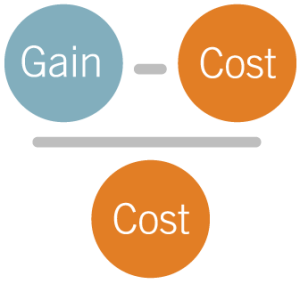

To calculate the classic ROI formula, the prospective business investor divides the cost of the investment into the estimated benefit or gain — the returns after costs are subtracted. The equation, expressed as a percentage, looks like this: Percent ROI = (Gains – Cost) / Cost.

It seems straightforward and simple: A negative number equals a poor ROI, while a positive one suggests a good investment — and the higher the positive number the better the investment potential. Yet the results can be deceiving, as the number can vary depending on what the investor includes in the “returns” and “costs” categories.

That’s why businesses sometimes use ratios to analyze a prospective investment. These ratios illustrate relationships between the investment and the expected increase in sales or net income it generates. And they can be analyzed alone or as part of the overall cost of operations.

The investment turnover ratio, for example, takes gross sales or revenue and divides this number by the company’s total assets. If the ratio is calculated on both the new investment alone and the investment as part of existing operations, its effects can be compared and seen in context.

A related ratio measures return on assets by dividing net income by total assets.

Whatever formulas work best for the potential investment, the business owner should know what inputs are being used as variables. Furthermore, the resulting ratios should be compared to industry standards or, absent those figures, to ratios resulting from the company’s previous lucrative investments.

The formulas can also be used to isolate specific moments in the company’s history that can be compared to detect trends.

Respect for Resources

Even if all the major profit-and-operations ratios point to a profitable investment in a company expansion, purchase or product outreach, the business can sabotage a positive ROI if it doesn’t research the market and involve core stakeholders in the project.

Rigorous planning that invites input from employees, investors and customers can identify potential costs and risks associated with any new investment, whether it’s introducing a new technology or buying a rival business.

Forecasting returns should never be done without also forecasting risks. The strategic plan for any business investment — big or small — should include room for solutions to every problem that planners can imagine.

Download 379_Return on Investment Begins at the Drawing Board PDF