Municipalities, businesses, tribes and economic development and other community organizations eager to attract capital investment to economically distressed areas of New Mexico have another avenue to do so.

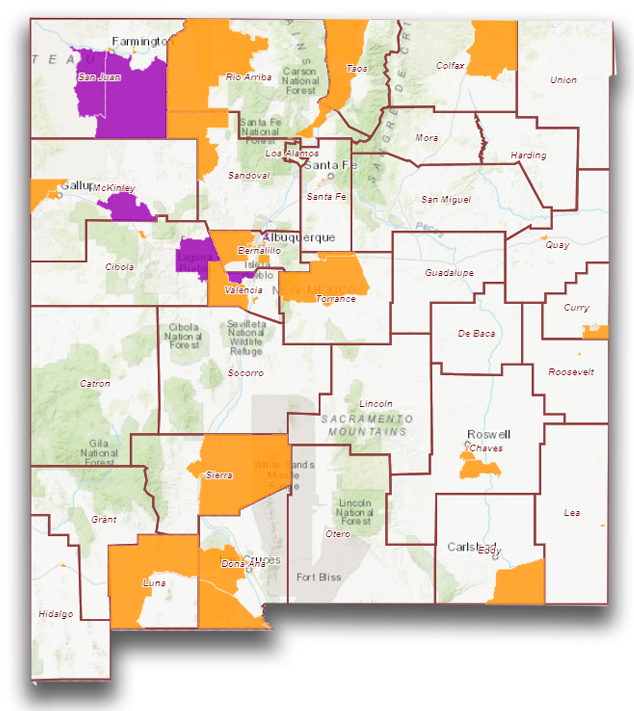

One provision of the Tax Cuts and Jobs Act of 2017 law allowed governors to nominate qualified census tracts in their states as Opportunity Zones (OZs). That designation offers tax incentives for individual entrepreneurs, partnerships and corporations to invest in communities where unemployment and poverty are high. New Mexico has 63 such zones scattered among 22 of the state’s diverse counties and tribal lands.

To sweeten the offer, the state is providing $1 million OZ Jobs Bonus to investments that meet certain OZ project benchmarks and help the state’s economy diversify.

The federal tax initiative is tantalizing in New Mexico, where outside financing can be hard to attract. Investors can defer, reduce or even remove certain capital gains taxes from OZ real estate and business investments made through a qualified Opportunity Fund that benefits affected communities.

The tax benefits are structured in three different ways:

- An investor can defer capital gains taxes owed on other assets by forming a partnership or corporation to invest in an Opportunity Zone property. That deferral lasts until the end of 2026 or until the investor disposes of the asset.

- An investor who shifts capital gains to an Opportunity Fund for at least 5 years can earn a 10 percent step up on the basis of previously earned capital gains. If the gains are invested for at least 7 years, the investor’s basis rises by 15 percent.

- Investors are permanently relieved of paying taxes on capital gains earned through an Opportunity Fund investment if they hold onto the investment for at least 10 years.

The tax benefits are available even if the investor doesn’t live or run a business in the OZ.

Local stakeholders, not the state, create the projects and recruit investors. But the state can lend some assistance.

The New Mexico Economic Development Department (EDD) created an online platform—the NM OZ Project Portal—where investors, businesses, local governments and other stakeholders can submit project ideas for review. Those eligible for the program are summarized in an EDD email sent to other interested parties, and the project is mapped and listed on the website’s project pipeline.

The EDD also funnels the project through FundIt, the official interagency task force charged with identifying potential funding for OZ projects and providing technical assistance. FundIt can point entrepreneurs and community leaders to existing resources that are available for some aspect of an OZ project.

Small communities in rural states rarely have economic development professionals, so the state is filling that gap, said Ryan Eustice, an economist at the EDD in charge of special projects and OZ development.

“Before trying to attract investment, municipalities should identify what is the No. 1 priority in their zone,” he said. “We encourage communities to step back and identify smaller hurdles. We won’t do the project for them, but we can walk people through.”

Local input is key to successful projects, Eustice said. He urged entrepreneurs to work with universities, startup incubators, accelerators and other economic development partners to explore creative ways to move projects forward.

EDD is hosting a webinar at 1:30 pm on Thursday, Nov. 19 to share best practices for maximizing the local impact of Opportunity Zones. For more information contact Johanna Nelson at johanna.nelson@state.nm.us

Resources for optimizing opportunity zones:

- NM OZ Project Portal

- National League of Cities OZ downloadable guide

- The Governance Project’s downloadable toolkit

- NM EDD YouTube page

Finance New Mexico connects individuals and businesses with skills and funding resources for their business or idea. To learn more, go to www.FinanceNewMexico.org.

Finance New Mexico article 637