By Finance New Mexico

The generation gap of the early 21st century is different than the one that led sociologists to coin that term in the 1960s, when young adult baby boomers were advised not to trust anyone over 30.

The generation gap of the early 21st century is different than the one that led sociologists to coin that term in the 1960s, when young adult baby boomers were advised not to trust anyone over 30.

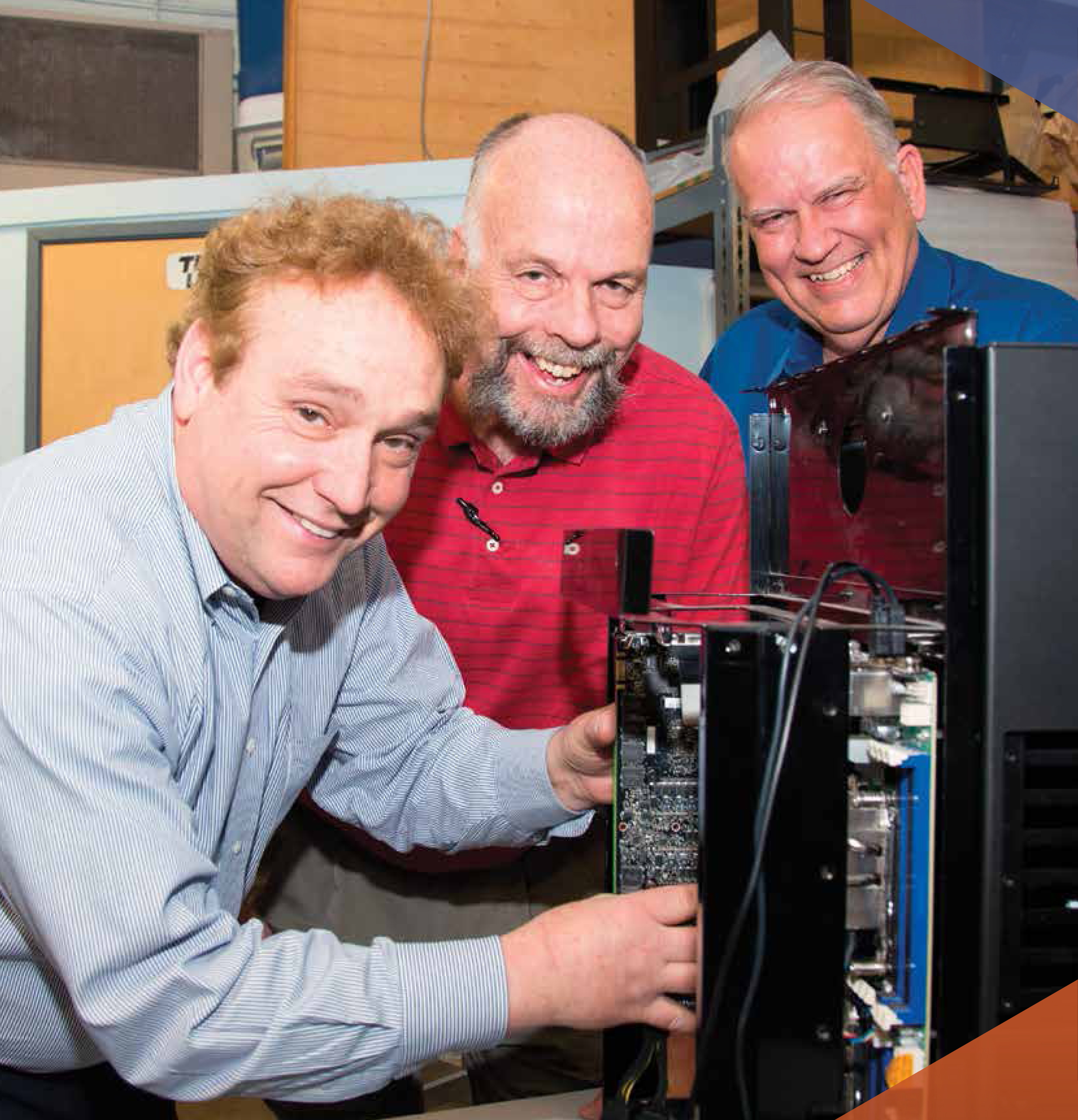

Today’s workplace might include people in their late teens up to their 70s. Managing that multigenerational mélange presents many of the same challenges as managing a multicultural one, but it also offers a rich resource for businesses that understand the strengths and benefits of diversity and appreciate that every employee, regardless of age, wants to work with others toward a common goal and feel productive and valued. Continue reading