Bronco Sue Custom Hats gets lots of walk-in traffic. Situated at the crossroads of New Mexico State Highways 54 and 70 in Tularosa, the retail store is a must-stop for those visiting south-central New Mexico tourist attractions such as White Sands National Monument, the town of Ruidoso and Lincoln Historic Site — the most visited state monument in New Mexico.

So when Kenneth and Lu Lyn Brasher, the owners of Bronco Sue Custom Hats, had the opportunity to purchase the building that’s home to their antique hat-making equipment and retail store, they jumped at the opportunity. Like many rural residents, the Brashers didn’t finance the property through a bank. “The people that we bought it from were the ones carrying the paper,” said Lu Lyn.

Time passed, the business grew, and the Brashers built their credit history outside of the conventional banking system. When their private lender passed away, they needed an institutional lender to refinance the building.

That’s when the Brashers went to the Tularosa branch of Western Bank. Besides providing checking and savings accounts to individuals, Western Bank matches the needs of business owners with state and federal lending programs that increase the amount of money available to a borrower. The lenders at Western Bank helped the Brashers refinance the Bronco Sue Custom Hat building using the Business and Industry Guaranteed Loan Program of the U.S. Department of Agriculture Rural Development.

Designed to Build Rural Communities

The B&I Guaranteed Loan Program aims to develop or finance business and industry that bring lasting community benefits — including jobs — to lower-population areas. Loans are available to qualifying ventures in towns considered rural — those with 50,000 or fewer people. This excludes only Albuquerque, Rio Rancho, Bernalillo, Las Cruces and Santa Fe. Towns close to these metro areas qualify as rural.

Western Bank and other rural financial institutions are eager to loan money through the B&I program because the federal government assumes up to 80 percent of the risk on loans as high as $25 million. This allows rural banks to put more money into the hands of borrowers who might not otherwise have qualified for a large loan.

Besides the purchase of buildings, facilities or land, B&I loan money can be used to buy equipment, machinery, supplies or inventory.

Well-prepared and uncomplicated loan proposals can be approved quickly. The Brashers’ loan took about 90 days to be funded, allowing them to maintain focus on their retail business and the custom hats that are cherished by tourists and repeat buyers who place orders online or in the store.

Turn-of-the-Century Business

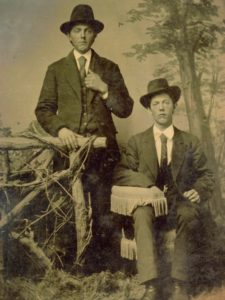

Bronco Sue Custom Hats started in 1997, “just before the turn of the century,” according to the website — and a play on words that refers to the Brashers’ collection of antique hat making equipment. The collection, which cost tens of thousands of dollars and took six years to assemble, includes blockers, wooden crown forms and other specialized equipment. Workers use the machines for what cannot be done by hand, creating custom brims, crowns and creases that make up one-of-a-kind hats. Hand work is used for made-to-order embellishments.

“Hat making has not really changed much in the past century,” said Lu Lyn. “Some of the equipment [we use] is over 100 years old” and it still turns out sturdy, long-lasting hats of distinction. Each hat is made individually using U.S.-made materials. “We’re very proud of that.”

Business owners interested in the B&I Guaranteed Loan or other programs of USDA Rural Development can visit the website at www.usda.gov or call the Rural Development State Office in Albuquerque at 505-761-4950. Present-day Pat Garretts and Billy the Kids should visit Bronco Sue Custom Hats at www.broncosue.com.

Download 488_Tularosa Hat Maker Stays Put With USDA Loan PDF

Hats off to Mr. & Mrs. Brasher, and to Dion Kidd, President/CEO of Western Commerce Bank!