Cabra Coffee in Cedar Crest financed growth through The Loan Fund

Most New Mexico entrepreneurs can’t start or operate a small business without occasionally borrowing money. And that requires preparation and a methodical approach.

It begins by identifying why the money is needed and the most appropriate loan to fulfill that need. It continues with finding a lender that offers optimal terms and fees for clients with the borrower’s credit score and financial resources and gathering documents the lender needs to review.

Define the need: Businesses may need loans for daily operating expenses or to build reserves, renovate a commercial building or buy equipment. The specific need typically drives the decision about what type of loan to shop for. Continue reading

Entrepreneurship is exhilarating and dynamic, especially in the beginning, as the business plan is set in motion and a product or service begins its path to market. The unpredictability of this journey is part of the reason it’s so stimulating to start and build a business, but maintaining that level of excitement and drive can be challenging when the business’s evolution doesn’t unfold according to plan.

Entrepreneurship is exhilarating and dynamic, especially in the beginning, as the business plan is set in motion and a product or service begins its path to market. The unpredictability of this journey is part of the reason it’s so stimulating to start and build a business, but maintaining that level of excitement and drive can be challenging when the business’s evolution doesn’t unfold according to plan.

Toby Rittner wants to help communities leverage their limited financial resources to solve the needs of business, industry, developers and investors.

Toby Rittner wants to help communities leverage their limited financial resources to solve the needs of business, industry, developers and investors. Small businesses are attuned to the risks they face when material costs and interest rates start to rise and competitors make inroads into their market share, but they’re not always conscious of less predictable but increasingly common risks, such as natural disasters. And they don’t always know about the resources available when their city or county is formally declared a disaster area and they become eligible for government assistance.

Small businesses are attuned to the risks they face when material costs and interest rates start to rise and competitors make inroads into their market share, but they’re not always conscious of less predictable but increasingly common risks, such as natural disasters. And they don’t always know about the resources available when their city or county is formally declared a disaster area and they become eligible for government assistance. Chambers of commerce are trade associations charged with creating a business-friendly environment for their members in the communities where they’re based. They do this by advocating, educating and providing a variety of publicity tools.

Chambers of commerce are trade associations charged with creating a business-friendly environment for their members in the communities where they’re based. They do this by advocating, educating and providing a variety of publicity tools.

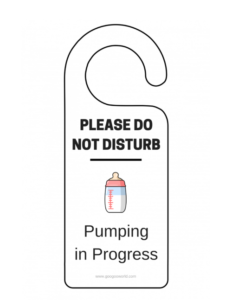

Employers who provide a space where employees can express and store milk or breastfeed a baby quickly realize the benefits of doing so.

Employers who provide a space where employees can express and store milk or breastfeed a baby quickly realize the benefits of doing so. If you whisk together hard work and passion and then throw in an effective loan program, your chances for small business success will likely be high. Those ingredients came together in Ruidoso, where Steven and Marie Gomez operate the Cornerstone Bakery & Cafe.

If you whisk together hard work and passion and then throw in an effective loan program, your chances for small business success will likely be high. Those ingredients came together in Ruidoso, where Steven and Marie Gomez operate the Cornerstone Bakery & Cafe.