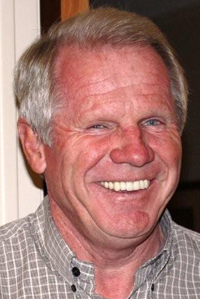

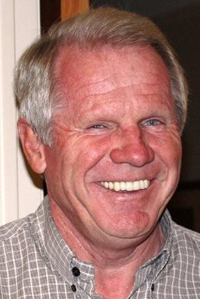

Paul F. Goblet, Financial Advisor, NMSBIC

Despite a nationwide financial crisis, New Mexico businesses continue to attract equity investments thanks to commitments made by current and previous legislators and governors.

Both Gov. Bill Richardson and his predecessor, Gov. Gary Johnson, saw potential benefits in supporting New Mexico businesses by providing equity capital for growth. Using capital that had accumulated in the Severance Tax Permanent Fund, our state launched the New Mexico Private Equity Investment Program in 1994, and it has grown through the infusion of additional capital commitments over the past 14 years.

The state program, which is managed by the State Investment Council, was designed to attract professionally managed equity funds like those operating in California’s Silicon Valley in the 1990s. Its creators believed that out-of-state equity-fund managers had expertise to invest in and develop New Mexico businesses and that their investments would lure additional funds and professionals. They were right.

If you build it, they will come

Chicago-based Arch Ventures was the first to establish a presence in New Mexico, but more than 20 additional funds have followed. Early investors were attracted by the vast amount of technology generated by the state’s research laboratories and universities, but other specialty funds have also been established.

Continue reading →